Jewellery and sports memorabilia helped the international auction houses contain their sales declines in the first half of 2025 but are not doing much to alleviate the pressures on the wider art industry. In a period marked by external uncertainties, including intensifying wars in the Middle East and the ongoing threat of global trade tariffs, art businesses are adjusting their models and offerings to meet a more financially prudent clientele.

First-half auction sales fell 6 per cent this year, to $4bn, after a 27 per cent slide this time last year, marking “a tentative phase of stabilisation”, finds the analysis firm ArtTactic. Its Rawfacts review covers fine art and luxury sales at Sotheby’s, Christie’s and Phillips, excluding real estate and classic cars, and including commissions.

The relative improvement was not universal. Sales of the industry’s core category of fine art fell 10 per cent, from $3.2bn in the first half of 2024 to $2.9bn this year — nearly half of its 2022 equivalent total of $5.7bn. Luxury goods, including jewellery and wine, were up 1.2 per cent. These, alongside other, generally lower-priced and higher-volume, non-fine art categories, grew their share of sales from 25 per cent to 28 per cent in the first half of 2025.

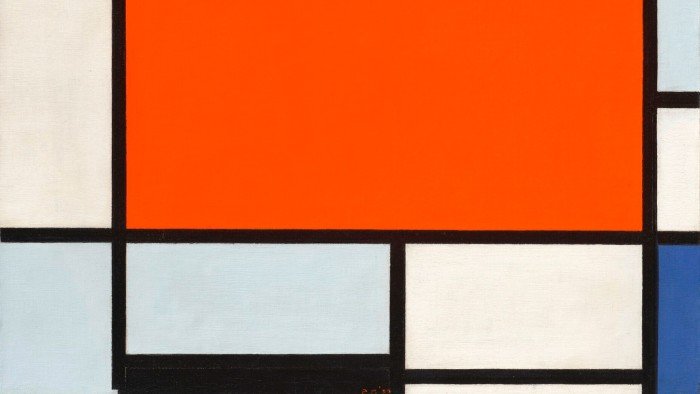

At Christie’s, which had the highest market share in the first half and posted the most stable total ($2bn versus $2.1bn last year), pockets of growth included luxury collectibles, notably its jewellery sales, which were up 25 per cent year-on-year, to $262mn. This included the $14mn sale of the “Marie-Thérèse pink diamond”: a 10.38 carat jewel (mounted on a modern ring by the Parisian jeweller JAR) once owned by Marie-Thérèse, Duchess of Angoulême, and perhaps also by her mother, Marie Antoinette, queen of France. “There is real market demand for luxury, signed jewellery,” says Christie’s chief executive Bonnie Brennan. Christie’s also sold the most expensive work of the period — a trademark, minimal Piet Mondrian from 1922, dominated by a square of red, for $47.6mn.

At Sotheby’s, where ArtTactic finds sales were down 9 per cent to $1.65bn, its small sports memorabilia category grew dramatically, by 189 per cent (total $28mn). This was boosted by items such as the jersey worn by the late Kobe Bryant at his first game for the Los Angeles Lakers basketball team in 1996, which sold online for $7mn in April.

At Phillips, where total sales fell the sharpest (down 14 per cent), more than a third of its total $318mn came from watches, an area where the auction house confirms it remains the market leader (35.5 per cent market share, according to ArtTactic).

Such numbers are not made available for the rest of the market, including galleries and art fairs, but anecdotal evidence suggests that the wider industry is having a rethink in tough times. “In moments of market uncertainty, it is particularly hard for self-funded businesses. Anyone who says otherwise is not telling the truth,” says the art adviser Nazy Vassegh. In March, she revealed she was postponing the fifth edition of her niche London fair, Eye of the Collector. The decision, she says, was not easy “but made in light of the changing world order and new geoeconomic and political factors”.

Meanwhile, the industry was shaken at the start of this month when the respected gallerist Tim Blum — who has galleries in Los Angeles and Tokyo and whose artists had included Takashi Murakami and Yoshitomo Nara — announced he was “sunsetting” his business after more than 30 years. Blum says the decision was based on challenges that were not “purely financial”, rather that “the real strain lay in the unsustainable nature of the model — a relentless, hamster-wheel grind in which even banner years were followed by the pressure to start over, often without building meaningful surplus or stability.”

Blum says he has not walked away from the art world but wants to “find peace” while looking into projects such as an artist residency in Northern California.

Others are similarly minded about coming off the market treadmill. Joe Kennedy, co-founder of London’s Unit Gallery, talks of a future that is “more about community-based initiatives”. He posted on social media that Blum’s gallery was one of his favourites and was “swallowed up by the rapidly commodifying forces that define the contemporary art market today: global art fairs, proliferating competition, and an uncompromising, self-serving consolidation of accepted art market conventions and hierarchies”. Since the post, Kennedy says he has had “hundreds of people message to thank me for speaking out”.

Vassegh identifies a need for a “pause” to work out “how to keep established collectors invigorated by art”, while also “converting the next generation of enthusiasts”. The latter, she says, “are acutely aware of all the social and environmental challenges and want to live life in a way that matches their value systems.”

Past norms of buying trophy art or speculating on young artists seem far removed from such thinking, though experts identify other areas — previously overlooked or under-loved artists — that are attracting attention. Brennan notes that at Christie’s, a record for a south Asian painting was set in March, when MF Husain’s nearly 14ft panel charting rural life in India — “Untitled (Gram Yatra)”, 1954 — sold for $13.7mn. Phillips currently has a selling show in London, a collaboration with Grosvenor Gallery, dedicated to more than 50 artists from south Asia (Crossing Borders, until July 31), with prices from £5,000 to £1.5mn.

ArtTactic finds that the market for old masters, long in the doldrums, grew 36 per cent in the first half of this year, just after which Christie’s made a record for the Venetian master Canaletto. On July 1, his c1732 work that had been in the collection of Britain’s first prime minister, Robert Walpole, sold for £31.9mn.

For newer art, events that tweak the art fair model — such as gallery weekends and smaller collaborations — are also hitting the spot. The São Paulo gallery Fortes D’Aloia & Gabriel has collaborated with Mendes Wood DM for the fifth edition of its summer exhibition in Comporta, Portugal, which runs until August 30. Alexandre Gabriel, senior partner at Fortes D’Aloia & Gabriel, says that while overall “sentiment is cautious”, he has seen a “growing spotlight on Brazil and the global south more broadly” and reports six-figure sales from the Comporta show, including for a thickly painted, new landscape by the Brazilian painter Marina Rheingantz. Kennedy sees opportunity ahead: “When the market is in a tight place, it can be exciting. It means there is fertile ground for change.”