How did the best years of Amani Lewis’s career turn into the worst time of the artist’s life?

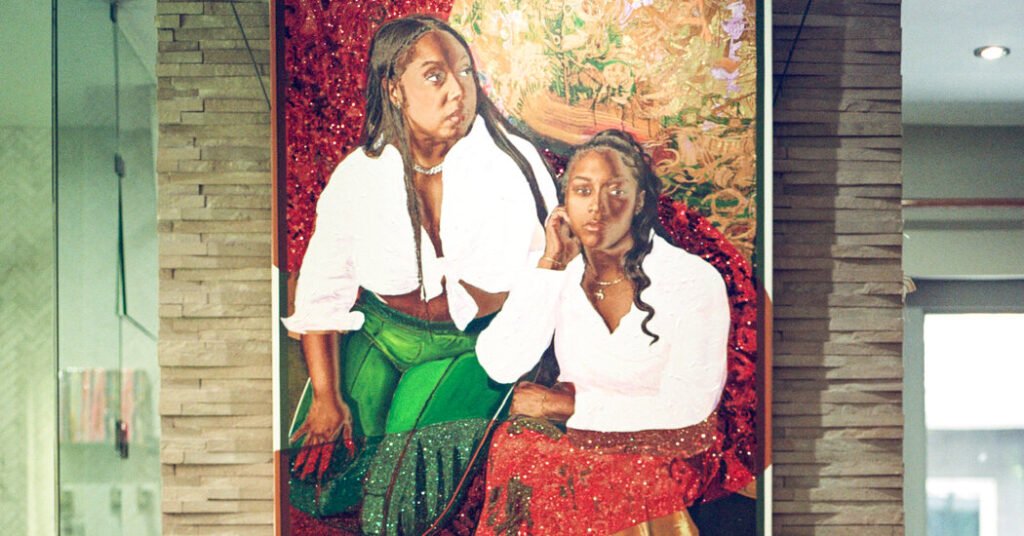

First came the meteoric rise. A haunting painting Lewis made in 2020 sold at auction just a year later for $107,100, more than double its estimate. Two other works had recently tripled expectations, and a collector offered $150,000 in cash for new pieces fresh from the studio. There were shows in Paris and Miami — Lewis had seemingly conquered the market at age 26, upgrading to a new art studio and a Tesla.

But when the original painting re-emerged at auction in June and its price plunged to $10,080 — losing 90 percent of its value — the party was over. By then, Lewis had stopped renting a $7,000-a-month luxury apartment in Miami and temporarily moved in with their brother.

“It was such a nice high and then it drops,” the artist, now 29, said. “It feels like, ‘We’re done with Amani Lewis.’”

Over the last year, as money drained from the art market, young art stars around the world experienced dramatic setbacks that submerged their careers.

The Ghanaian artist Emmanuel Taku had a painting sell in 2021 for $189,000 only to watch its price drop in March to $10,160 at auction. Cubist-style portraits by Isshaq Ismail, which sold for as much as $367,000 two years ago, have failed to rise beyond $20,000. Allison Zuckerman, a Brooklyn artist, also felt the market’s contractions; her riotous painting “Woman With Her Pet” sold for $212,500 three years ago, but mustered only $20,160 at auction in June.

What happened to the bull market and the notion that all artworks appreciate in value? The art market has been experiencing a downturn for the last few years, but the slump has been particularly acute for young artists. During the early pandemic, a speculative boom driven by a misplaced belief in quick returns set in, with collectors spending $712 million at auction in 2021 on works by artists born after 1974 — a giant leap from the $259 million buyers spent just a year earlier. But from 2021 to 2023, the prices for these artists — “ultracontemporary” is the industry term for them — plummeted by almost a third, according to the Artnet Price Database.

Experts say the downward trend is continuing; in the first half of 2024, sales of work by young artists fell 39 percent over last year. Collectors had overestimated the market’s strength; fearing the work might soon become impossible to sell, they wanted to make at least some of their money back — regardless of what public flops might mean for an artist’s future.

Artists rarely benefit from high auction prices, since most works at auction are sold by collectors who have bought their works earlier and are now hoping to sell them for a profit. The artists also rarely speak — as they do here — about how art market speculation affects them personally and professionally. In retrospect, Ismail, 34, said he regretted selling up to five works at a time to art advisers and collectors — who swiftly resold them. “Everyone wants a piece of the cake,” he said, recalling how buyers made offers over email or on Instagram. It was hard to tell genuine collectors from speculators, he said.

Then, around 2021, record high prices caused a stampede of sellers, which flooded the fragile market. Gallerists raised artists’ prices but in some cases they overshot the target, discouraging potential buyers. When a dealer raised Lewis’s prices in 2022, the artist’s exhibition failed to sell out, adding to the financial strain. That was the beginning of the end.

“When the prices inflate that much, everyone gets really excited — and people tend to make a lot of mistakes,” said Loring Randolph, director of the Nancy A. Nasher and David J. Haemisegger Collection of art in Dallas. Buyers who felt they overpaid are “really pulling back now.”

Guessing Which Way the Pendulum Will Swing

Laurent Mercier, an art dealer representing Emmanuel Taku, said in a text message that what happened to the artist was “very sad and crazy.”

In 2021, Mercier said, Taku’s paintings had nearly 500 wait-listed buyers and promises of museum donations that would improve the artist’s reputation. But in the next two years, as other dealers entered the picture, works by Taku suddenly flooded the market, with supply outstripping demand. Prices began to collapse with some collectors offloading the artist’s work at auctions. Now Mercier is trying to clamp down on sales to build back demand.

“People don’t want to miss out and in the end will overpay,” Mercier said. “Then the pendulum swings the other way and even at too-cheap prices, few want to get in.”

Mercier said that he and Taku were organizing a comeback and “cleaning up the mess,” and that Taku’s paintings should go for $25,000 to $50,000 (compared with previous heights closer to $189,000).

Allison Zuckerman was 27 and working in her cramped apartment in Williamsburg, Brooklyn, when the mega-collectors Donald and Mera Rubell discovered her, buying more than 20 pieces. (She stashed dirty clothes under the bed before their visit.) Since 2021, her work has sold at auction 59 times, a remarkably high volume for a young artist. “It feels very out of body,” Zuckerman said of watching auctions. “Everything that went into that painting — the discoveries, resolving that one corner, that brushstroke that really brought the whole thing together — isn’t what’s being talked about.”

While Zuckerman said most of her paintings sold at a solo exhibition in June for $35,000 to $65,000, she couldn’t ignore the auction debacle for “Woman With Her Pet” that same month: Someone tagged her in an Instagram post about the 91 percent price drop while she was on her honeymoon.

Running the business side of a career is rarely taught in art schools. “Grad school for me was about finding my voice,” Zuckerman said. “I wish I had taken a business course.”

Today, she’s making a new body of work about losing control of her paintings in the market. “Reclaiming it is the only way I can have a sense of agency,” she said.

‘The Hardest Year of My Life’

“There are things I should have done with the money I made to protect myself from the current situation but I didn’t,” Lewis said. Recalling a difficult upbringing in Baltimore — “I’ve lived in cars, I come from the hood” — the artist nevertheless considers 2023, when the speculative bubble burst, “the hardest year of my life.”

That year, a collector messaged Lewis saying he was “agonizing” over whether to sell one of the artist’s paintings. “I moved to a 120-year-old house that has some expensive issues and your painting is one of the few sellable things I own,” the collector said in the message viewed by The New York Times.

“If you want to renovate, take out a loan, bro,” Lewis said, recalling the incident. Ultimately the work sold for about $10,000 with fees — $2,500 more than the collector originally paid, according to the artist, but a fraction of what he hoped to make.

Speculation is characteristic of the art market’s long history of buying frenzies that later crash in disillusionment. In the 1980s, a strong Japanese economy and a buoyant American stock market drove art sales to new heights. When 1990 came around, Japan entered its “lost decade” of financial woes and the American stock market crashed; half the contemporary artworks offered in major auctions that fall failed to sell.

Again, in 2014, a group of young artists whom critics called the “Zombie Formalists” because of their retro abstract styles became market darlings. Three years later, many of their paintings sold for a fraction of their peak prices — if they sold at all.

But the spectacular implosion of today’s market for young artists is different. There is a lot more money — and a lot more art — flowing through the system than before. The average price of a contemporary artwork sold at auction in 2021 was nearly $60,000, 40 percent higher than during the “Zombie Formalism” craze, according to the Artnet Price Database.

Georgina Adam, the author of two books on the contemporary art market, said that changes in taste previously dictated the rise and fall of artists over long periods of time. Today, she said, the cycles are shorter and “the reason is speculation.” More than a third of the buyers at Christie’s and Sotheby’s in 2021 were new clients, and Adam said they may have been more interested in turning a profit than becoming lifelong patrons.

For their part, the major auction houses say they are dedicated to fostering a healthy market for emerging artists. “Our team uses primary market data and activity to offer their works with considered estimates in a manner that is responsible, with a long-term view,” a spokeswoman at Phillips, Jaime Israni, said.

‘You Are Buying a Piece of My Life’

But speculating on artists is different from speculating on stocks and cryptocurrencies. Artists say it feels intensely personal.

“You are buying a piece of my life — a little history of me and my people,” said Lewis, who gives the subject of every portrait a portion of the proceeds from each sale. Such charity is rare in the United States — where living artists, not to mention their subjects, have no legal claim to the proceeds of a sale by a collector or institution.

Lewis and other artists say the experience of navigating the market gauntlet has made them stronger. Ismail, for example, now sells his work exclusively through galleries.

In October, Lewis will have their first gallery show in two years at the Mindy Solomon gallery in Miami. The new works — richly colored images that look as if they were stirred up in a washing machine — were inspired by this recent and tumultuous chapter.

“This is the perfect time to be buying Amani Lewis,” the artist said. “If you’re not buying it, you are going to wish you did.”