What are alternative investments?

In today’s dynamic investment landscape, alternative investments have emerged as a strategic avenue for diversifying portfolios beyond traditional stocks, bonds, and cash equivalents. With the volatile market of recent years, under-the-radar investments like art, vintage vinyl and luxury spirits may have the potential for positive returns. By delving into these lesser-known avenues, investors can redefine their investment strategies for long-term success.

Rare Collectibles

When investing in physical items or rare pieces, it is not simply about buying to keep but rather about purchasing as an investment and selling when the value appreciates over time. These investments are characterised by their potential for higher returns, low correlation to traditional markets, and diversification benefits that can enhance portfolio resilience against market volatility.

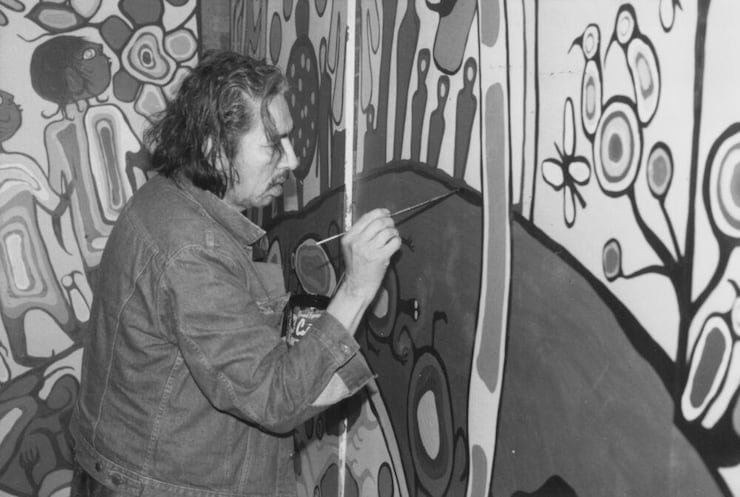

Art

Is art an ideal asset? Investing in art can be done in one of two ways. The first is to acquire art itself and the second is to buy shares of an artwork. The latter is a relatively new concept that merges traditional art ownership with the financial structures of equity investment. Here is how it works — investors can purchase fractional shares in valuable artworks on specialised platforms or companies that facilitate these transactions. They acquire artworks to fractionalise the ownership rights, and investors then buy these tokens or shares representing their ownership. Once the artwork generates income — typically through exhibition fees, loaning to galleries, or even digital rights, the platform distributes dividends to the investors. The amount of dividends each investor receives is proportional to their ownership stake in the artwork. In 2019 an online platform dubbed “Feral Horses” was set up in a bid to democratise art ownership, “enabling individuals to support their favorite artists for as little as a fiver,” according to co-founder Lise. The potential returns on these investments come from the appreciation in the artwork’s value over time and the income generated from its use. However, this model also carries risks, including the volatility of art prices, maintenance costs, and the overall demand for the artwork.

Critics are right to point out that art is subjective and the value of art can vary widely among experts and collectors. Determining the true market value of an artwork can be challenging and may not always reflect the purchase price or initial investment. Furthermore, there may not always be a clear path toward an exit strategy. Finding a buyer willing to pay the desired price for a fractional ownership stake in an artwork may take time and could involve negotiation, so what an investor may end up doing is putting money into an artwork that effectively never brings in any major profits.

Wine

Rare wines are not only valued for their taste but also for their scarcity, provenance, and historical significance. The value of certain vintages from prestigious wineries or regions can appreciate over time. Investing in rare wines often requires a long-term investment horizon. The value appreciation of rare wines can be realised over years or decades, particularly for well-regarded vintages that gain prestige and rarity over time. According to rarewineinvest.com, wines are described as “a better investment than both real estate and stocks”, because it combines a stable return with low risk. Their statistic also state that the risk of wine investment is substantially lower than for investments in the stock market. Wine provides stable returns year after year and only very rarely decreases in value.

It is also worth noting that wine prices can fluctuate based on economic conditions, consumer trends, and global events. Investors should be prepared for potential price volatility in the wine market. Rare wines can be illiquid assets, meaning they may take time to sell at desired prices. The liquidity of wine investments depends on market demand and the rarity of specific bottles or vintages. Overall, investing in rare wines offers the potential for capital appreciation, portfolio diversification, and enjoyment of a tangible luxury asset. It appeals to investors interested in combining financial returns with cultural appreciation and passion for wine collecting.

Whiskies and Spirits

Whiskies and premium spirits are valued for their craftsmanship, rarity, and age. Certain bottles from renowned distilleries or limited editions can appreciate significantly in value over time. According to the Knight Frank Luxury Investment Index, rare whiskies have outperformed gold, wine and equities. There is a growing global market of collectors, enthusiasts, and investors who seek rare and unique whiskies and spirits. This demand is driven by connoisseurship, cultural appreciation, and investment potential. According to Grand View Research, the global whisky market is projected to reach USD 84.5 billion by 2025.

Like rare wines, some whiskies and spirits are produced in limited quantities due to factors such as distillery capacity, aging requirements, and regional regulations. Their limited supply contributes to their investment appeal. Damgooddrams reports that brand reputation, age and rarity are all factors influencing the whisky investment market. Age statement whiskies, in particular, have consistently increased in value over time, averaging 12 percent per annum. A limited-edition of whisky bottle or rare bottles of whisky can rise in value as supply diminishes.

The risks involved are primarily in regulation as a whisky investment is not regulated like the financial services industry, so it is important to choose a reputable distillery not to take risks one cannot afford. Ensuring the authenticity and provenance of whiskies and spirits is crucial. Investors should verify the origin, distillation details, bottling information, and storage conditions to authenticate the investment.

Furniture

Antiquities are generally less risky forms of investment as rare pieces and first editions don’t lose value over time. Limited production and historical circumstances can affect their scarcity and drive up their market value. There is a dedicated market of collectors, interior designers, and enthusiasts who actively seek out antique furniture. This demand can create competitive bidding and drive prices higher at auctions and private sales. However, there is also a consideration of factors such as authenticity, condition, provenance, market trends, and maintenance costs. If a buyer can take good care of an antique piece, they can increase in value by up to approximately 10 percent a year, with rare pieces growing even more rapidly. Therefore, they are an asset that will always stay in style. Value and proper authentication are the risky setbacks to these investments as authentication by a reputable source can make a piece can more valuable.

Vinyl

Recent years have seen a resurgence in the popularity of vinyl records particularly among Gen Z listeners and their desire to connect with analogue music. According to The Recording Industry Association Of Japan (Riaj), 2024 over 2.69 million analogue records were produced in Japan in 2023, increasing by 126 percent from the year before while sales of analogue records in Japan reached JPY 6.267 billion (approximately USD 39.94 million) in 2023, which was the first time the market exceeded the 6 billion mark since 1989. While music streaming platforms have become part of the norm worldwide, vinyl production volume and value have soared by 70 percent from 2020 to 2021.

Surpassing expectations of being a nostalgia-led fad, the global vinyl market had already reached USD 1.7 billion in 2022 and is only poised to grow even further to USD 2.8 billion in 2028. The rise of vinyl enthusiasts as well as heavy promotion from labels and artists, like Taylor Swift who recently released analogue albums alongside their digital launches, have fuelled this demand after her latest album sold 700,000 copies just a week after it was released.

Should one be from a financial background and have no interest in music, successful investing in vinyl records requires knowledge of music history, album authenticity, grading standards, and collector preferences. Engaging with knowledgeable advisors and collectors can help mitigate risks and enhance investment outcomes but ultimately, investing in vinyl records offers opportunities to combine financial returns with cultural appreciation and nostalgia for physical music media.

Silicon Valley

Venture capitals are investment vehicles that provide capital to early-stage or growth-stage startups with high growth potential. In Silicon Valley, venture capitals play a pivotal role in funding innovation and disruptive technologies across various sectors, including artificial intelligence (AI) startups, biotechnology companies; involved in pharmaceuticals, genetic research, medical devices, and digital health solutions, fintech innovations, and clean energy startups to name a few. Investing in venture capital funds that specialise in funding early-stage technology startups in Silicon Valley often focus on disruptive technologies across the aforementioned range of sectors. Venture capitals typically invest in exchange for equity stakes in startups, aiming for significant returns upon successful exits, such as initial public offerings or acquisitions. These investments often involves rigorous due diligence, assessing market potential, technology scalability, and management team expertise. Investing in venture capitals entails high risk due to the early-stage nature of startups and uncertain market conditions. However, successful investments can yield substantial returns, often exceeding those from traditional asset classes over the long term. Beyond financial support, venture capitals in Silicon Valley often provide strategic guidance, mentorship, and industry connections to portfolio companies, fostering growth and market expansion.

Commodities

Silver

Silver, like gold, is often seen as a hedge against inflation. When the value of fiat currencies decline due to inflation, precious metals tend to retain their value or even appreciate, making them a store of wealth. Including silver in a portfolio helps diversify risk as precious metals typically have a low correlation with other asset classes such as stocks and bonds. This means that when the value of traditional assets like stocks decreases, silver prices may not necessarily follow the same trend. While gold is seen as a stable investment option, silver has significant industrial applications. It is used in electronics, solar panels, medical equipment, and various other industries. This industrial demand can create a stable underlying support for silver prices, especially during economic expansions. In comparison to gold, silver is more affordable for individual investors. This accessibility allows a broader range of investors to participate in the precious metals market and its characteristics as a tangible asset with intrinsic value complement traditional financial assets, enhancing portfolio resilience. Alongside this, silver and silver coins are physical assets that can be held directly by the investor. Unlike stocks or bonds, which represent ownership or debt in a company or entity, silver coins provide tangible ownership of a precious metal with inherent value.

All That Glitters, Isn’t Gold(Coin)

While alternative investments have potential to bring in profits, the rise and fall of cryptocurrency showcases just how volatile the market for “unique” investments and digital assets can be. The unregulated nature of cryptocurrencies alongside the security challenges of cryptocurrency has made this asset class susceptible to hacks. As reported by various media sources, cryptocurrencies like Bitcoin have faced scalability challenges, which have led to high transaction fees and slow confirmation times. This has limited the practical use cases of cryptocurrencies and has led some to question their viability as a means of payment.

Similarly, Non-Fungible Tokens (NFTs) initially emerged as a potentially revolutionary concept however its rise that emerged during the economic uncertainty of inflation and the impacts of the COVID-19 saw a decline as markets stabilised and returned to normalcy. As Forbes reports, the overall decline in the cryptocurrency market is closely tied to the NFT ecosystem. As the value of major cryptocurrencies fell, so did the purchasing power and enthusiasm of many NFT investors. This downturn in the NFT space was not an isolated event but part of broader turmoil in the digital asset market, significantly influenced by significant catastrophes in the cryptocurrency industry and changing global economic conditions. Therefore, navigating the world of alternative investments requires careful consideration of factors such as liquidity, risk management, regulatory requirements, and market dynamics.

For more on the latest in business stories and opinion reads, click here.