And the UK is one of the world’s foremost hubs of the global art market. It’s bigger than China, the 27 EU states in their entirety, while only being surpassed by the United States. And the market shows no sign of slowing down. In today’s lightning-fast investment world, there are more options and opportunities available at our fingertips than ever before. Yet art has lost none of its allure, remaining a popular and attractive choice amongst savvy investors. Here’s the lowdown on why investing in art is not only offers cultural enrichment, but potentially financial too!

Art is a resilient asset

Art as a tangible asset

You don’t have to be a hot-shot investor to know we live in most uncertain times. The global economic sands shift speedily under our feet, and we must contend with trends such events such as inflation, automation and climate change. As we chart these often-stormy seas, art is a real, physical asset that has doesn’t follow the peaks and dips of the stock market. Unlike stocks and bonds, which can perform in a most volatile manner, art can be a stable investment that may appreciate in value over time.

Supply

By its very nature, the value of art is driven by its comparative scarcity. When a piece of art is one of a kind (or is only available in limited quantities), it can become more valuable because of its exclusive nature. Rarity of any asset always tends to add value, and in the art world, this is particularly true when collectors seek pieces from famous, in-vogue artists, or from a certain period in time.

Demand

In recent years, there has been an increase in the demand for art. A major factor in this trend is the expansion of the market across the globe. New and emerging markets such as China and India have been created by the growth of the middle classes. As their affluence increases, so does their thirst for art. For affluent individuals, owning art is often a demonstration of their status, prestige and of course, wealth. As the number of wealthy people increases over the planet, so will the potential demand for art. When you invest in art, you can tap into the growth of these expanding markets.

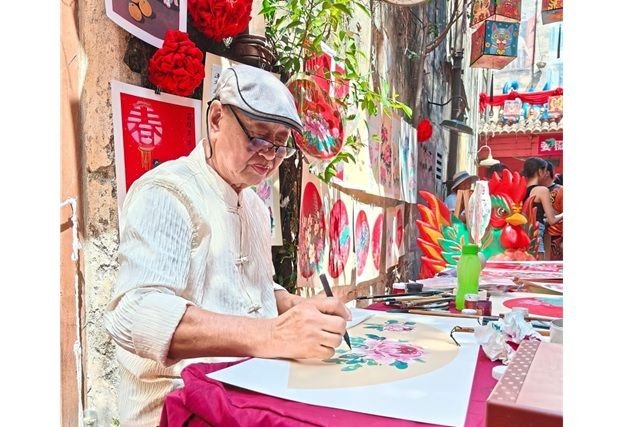

Emerging artists

While we’d all love to have a highly sought after artwork from an established artist in our possession, the market is not all about such pieces. New contemporary artists are constantly emerging everywhere and will always attract attention. Getting in on the ground floor and investing early in an emerging artist’s career can be a lucrative move as they rapidly gain acclaim and popularity.

Increasing accessibility

Art has become more accessible than ever before due to technology. The internet has made it easy to discover, access and purchase art all over the world. Online galleries and art marketplaces have sprung up everywhere, allowing people to see art anywhere from their armchair, and enabling artists to demonstrate and sell their pieces. Social media has also given emerging artists a digital shop window to showcase their talents to a wide audience. Access to investment opportunities has been increased by fractional art ownership, where investors can buy shares of artworks. Investing in art is no longer a game solely for the rich.

The potential of returns

As we’ve seen, the art market has demonstrated incredible resilience in recent years. And the sale prices at auction achieved by some renowned pieces are frankly mind-boggling! Of course, such prices aren’t realistic for most art out there! But while the market can be cyclical, with trends and artists changing with the fashion, there is potential of significant growth of in value of art over time.

Here’s what you need to know about investing in art

While art as an investment can generate significant returns, it is crucial to do your research and due diligence. This is especially important if you are new to the market. Here are some of the things you should consider.

Know the market

If you don’t understand how a market works, then you should not invest in it. This is true of any investment opportunity, not just art. You should learn about the different types of art, the history and keep a close eye on trends, both current and recent. You also need to know how the art market works. Research where it’s bought and sold and immerse yourself in art market indices to learn about value and trends.

Tap into expertise

Authenticity

If you’re thinking of buying, then authenticity is paramount. You need to be 100% certain that what you’re buying is the real thing. Documented history of ownership (provenance) is a must. Genuine, reputable dealers, galleries and auction houses will always have this information.

Budgeting

Always budget carefully and remember art is a subjective and often deeply emotive thing! Never overextend yourself financially and exercise caution. Take a long-term perspective Art investment is a long game. If you’ve an investor who likes to buy and flip investments quickly, this game is not for you. You need to be prepared to hold on to your art for a considerable period before generating strong returns. Also, remember that art is not a very liquid asset. The process of finding, buying and selling art is not always quick, and not always easy, despite the improvements in technology. And remember, like any investment, there are no guarantees of success. Art is one of the many alternative assets one should look at as part of a diverse portfolio.