India’s ultra-high net worth individuals ( those with a net worth of $30 million and above) allocate at least 17 per cent of their wealth towards passion assets, and luxury watches is the most coveted investment category, revealed the Knight Frank Wealth Report for 2024.

Not far behind are art and jewellery, which emerge as the top three categories of investment for these discerning individuals. However, on a global scale, the elite echelon of the super-rich show preference for art, trailed by luxury watches and classic cars.

Click here to follow our WhatsApp channel

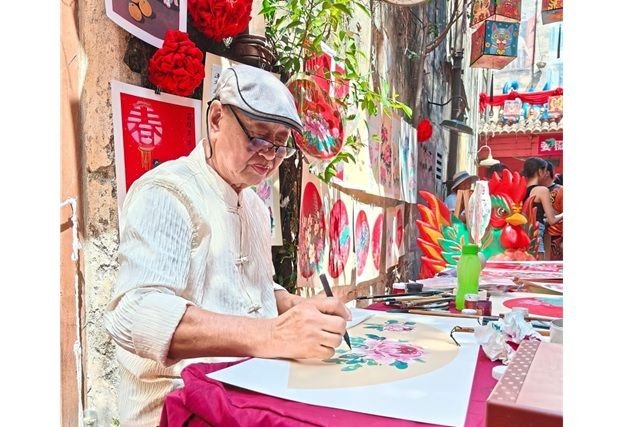

Passion investments include items like artwork, vintage cars and fine wine. Some categories can see returns on investment, but passion investments are also subject to supply and demand. The most important thing about passion investing is collecting items you love and are happy to hold on to for the long term. ““Unlike stocks or bonds, you can enjoy your ownership of passion assets by displaying them and sharing them with friends. A passion investment can also be part of your legacy and something you can pass down to your children and grandchildren for them to appreciate,” said Eric Rizza, managing director of investments with Ascent Private Capital Management of U.S. Bank.

Investment of Passion, category preference by UHNWIs in 2023

According to the annual Knight Frank Luxury Investment Index (KFLII), which tracks the performance of 10 popular investments of passion, art was the best-performing luxury asset class with prices rising 11 per cent in 2023. Despite the major auction houses observing a year of record-breaking sales in the luxury investment market, the KFLII edged into marginal negative territory for the second time, declining by 1% in 2023 as several constituents of the index dropped into the red or showed minimal gains. Despite witnessing a depreciation of 9% in the last 12 months, over a longer period of 10 years, rare whisky continued to command its premium value registering 280% returns.

Even though the price of whiskey is down 9 per cent over a 12-month period, it is up 280 per cent over 10 years.

The joy of ownership has been cited in the survey as the prime reason for Indian UHNWIs to make investments in luxury assets, the consultant said.