Investing in art-backed debt is among the least understood ways that people make money investing in art. It is also the best way to get started as an art investor.

Investment in blue-chip art, like other hard assets, was, until recently, inaccessible to anyone other than the ultra-wealthy (with well-connected art advisors and unlimited budgets). There are now a few firms that offer investment in art equity through fractional ownership of artworks or collections of artworks. Those investments are based on the prospects of long-term capital appreciation. But investing in art-backed debt has long been the reserve of people with institutional-level wealth. Private equity firms and hedge funds, for example, invest in art loans (helping the high net worth to increase their wealth, one art loan at a time), but until 2019, art debt was not an asset class that was available to retail investors.

Investing in portfolios of art-backed loans provides investors a way to generate stable, passive income with a strong level of principal protection, as long as the underlying loans are carefully underwritten and serviced by experienced art finance professionals. When art is the lender’s collateral, the liquidity of the artworks is important: the artists in the art loan portfolios should have demonstrated auction sales histories and the support of top galleries and museums around the world. Valuations of the artworks have to be accurate and conservative, and the loan-to-value ratios should be low.

Art investors are basking in the light of a very good 2022

Last year marked one of the most volatile and worst-performing years for public markets. The historic drawdown was fueled by fears of an upcoming recession, driven by inflation levels not seen since the 1980s, the Fed’s hawkish monetary policy decisions, and increased geopolitical tensions. While historically, fixed income has provided investors a safe haven during equity sell-offs, the last two years were an exception. The rising rate environment led to falling bond prices (bond prices have an inverse relationship with interest rates). Many investors were left scrambling to supplement their portfolios with assets to hedge against their losses.

Against this backdrop, art investments steadily gained traction. According to the recently published Art Basel and UBS Art Market Report 2023, global art sales increased by 3 percent year-on-year in 2022 to an estimated $67.8 billion, bringing the art market higher than its pre-pandemic level in 2019. The high end of the market (works priced at over $1 million) continued to be the driver of growth. Similarly, although the dealer sector grew by 7 percent overall, to $37.2 billion, sales in the larger galleries (those with more than $10 million annual turnover), increased by 19 percent in 2022.

2022 also marked a record-breaking year at the top levels of the market as the three major auction houses (Christie’s, Sotheby’s, and Phillips) all recorded their highest years of sales. Highlights included the sale of Andy Warhol’s portrait of Marilyn Monroe for $195 million in May 2022—the most expensive artwork ever publicly sold by an American artist. On the back of a great year for the art market overall, demand for both fractional art ownership and investment in art-backed loan portfolios grew, as investors looking to diversify their portfolio or reduce overall risk viewed these art investments as attractive options.

Art investments are a potential hedge against public market volatility and inflation

Last year proved what investors have long considered a key value proposition: art investments can act as a hedge against broader market volatility. Unlike many other assets like fixed income, art is not directly tied to fluctuations in the stock market or other traditional investments. Historically, art investments have held their value during times of economic volatility. Unlike other assets such as real estate or stocks, prices have generally remained stable or continued to increase, especially for blue chip, or top-tier and high-value artworks, providing investors the opportunity to benefit from long-term capital appreciation.

During the last major global financial crisis, auction prices fell by roughly 27.2 percent between 2007 and 2009 for blue chip artwork, according to Sotheby’s Mei Moses Art Indices. In the same time span, the S&P 500 fell 57 percent from its peak in October 2007. However, by 2011, total art sales had rebounded and matched 2007 levels, while it took the S&P 500 an additional two years to reach pre-crisis trading levels. Art has also long been regarded as an inflation hedge. Unlike cash or other financial assets, which are directly impacted by inflation, investments in art often hold their value.

Optimism abounds as the global art market expands

The global art market has been consistently expanding. Some of the largest art sales in 2022 were driven by single-owner auctions. Most notably, the unprecedented sale of the late Paul Allen’s collection of 60 artworks brought in $1.5 billion at auction. These collections are prized because of what Yieldstreet has termed “Provenance Premium.” When the ownership history includes prestigious, world-renowned art collectors, the provenance is itself a significant driver of value, as demonstrated by Christie’s blockbuster sales of the collections of Peggy & David Rockefeller, Paul Allen, and Thomas and Doris Ammann, to name only a few. The number of legendary art collectors who will offer their collections over the next five to 10 years is also anticipated to grow.

According to Dr. Clare McAndrew, author of The Art Basel and UBS Art Market Report, the high-end of the market fares particularly well with challenging economic headwinds, and at auctions, the number of works sold at prices above $10 million rose by 12 percent in 2022. And although public auction sales were $30.6 billion (down 2 percent YoY), it was still 11 percent higher than pre-pandemic 2019 levels. Private sales at auction houses generated $3.8 billion, down from the $4.1 billion reported in 2021. But despite that drop, McAndrew noted that the market is also becoming more liquid, making it easier to buy and sell art in the secondary market. In the last 10 years alone, artwork turnover has doubled. In the last 20 years, it has multiplied 31x.

Increased liquidity makes financing options more readily available for art collectors and investors, who use their artworks as loan collateral. Art loans provide them with easier access to capital, even during periods of market volatility, so that they can take advantage of buying opportunities.

Higher artwork turnover has particular relevance for investors in portfolios of art-backed loans. Liquidity works to the advantage of art debt investors because the loan collateral can be sold efficiently and effectively in the event of borrower defaults.

The Art Basel and UBS Art Market Report concludes with collector sentiment surveys. In 2022, 77 percent of wealthy people surveyed spent more money on art than they had prior to the pandemic and felt very good about the art market’s prospects in 2023. A whopping 84 percent surveyed in the U.S. were optimistic about 2023 and the future.

If the last two years have taught us anything, it is that private market alternatives should be a fundamental part of any well-diversified investment portfolio. Investors should consider making art-backed debt a larger and more important component of their wealth-building strategy.

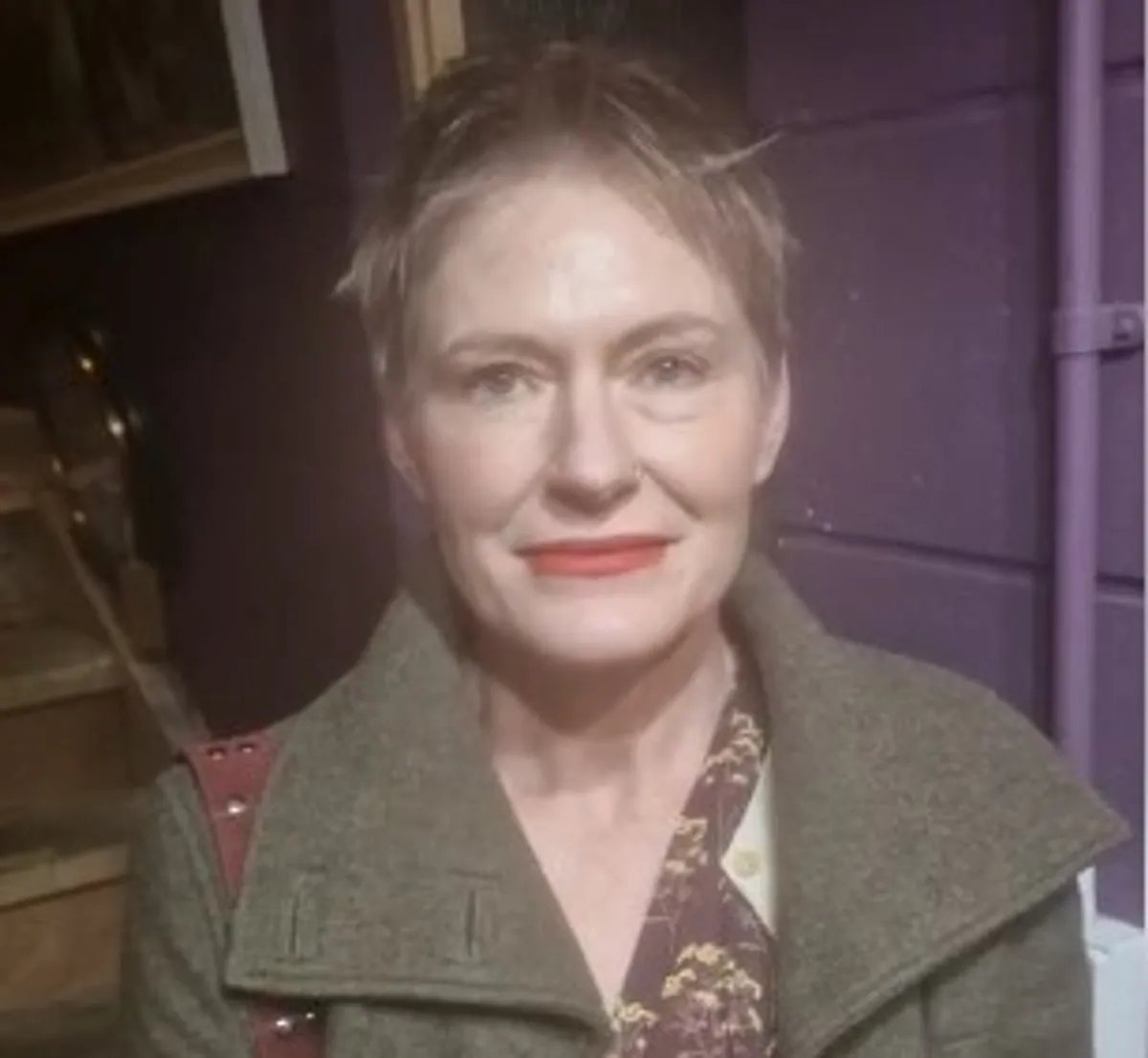

Rebecca Fine is the Managing Director of Art Finance at Yieldstreet, a private market alternative investments platform. She has over 25 years of experience in the art market and art finance.