“In this world, nothing is certain except death and taxes.”

While Benjamin Franklin may have had the constitution of the United States in mind, it is no less relevant for high net worth individuals and, in particular, the trustees of their estates when assessing inheritance tax liabilities.

This article considers how art finance arrangements can be utilised to provide much needed liquidity where UK inheritance tax is due in respect of estates with illiquid assets.

Inheritance tax

UK-domiciled individuals are liable to IHT when they die on their worldwide estate. Non-UK-domiciled individuals are liable to IHT in respect of assets that have a UK situs.

IHT is charged on the value of relevant assets forming part of the deceased’s estate (including real estate, investments and art).

The standard rate of IHT in England and Wales is 40 per cent, which is charged on the part of the individual’s estate that is valued above the tax-free nil rate band of £325,000 – a threshold far exceeded by those generally characterised as ‘high net worth individuals’ (even where unused nil rate allowances of a spouse or civil partner are taken into account).

IHT is due within six months of the deceased’s death, after which HM Revenue & Customs will start to charge interest on any unpaid IHT.

Some estates often have sufficient liquidity to settle the IHT due and then payment can be made directly from the deceased’s bank account(s) through the government’s direct payment scheme.

If there is insufficient liquidity within the estate to settle the total amount of IHT due, however, assets of a sufficient value may need to be sold in order to pay the IHT, and this will need to be done within the six-month period from death if interest charges are to be avoided.

This can be problematic where estate assets are illiquid (due to their value, size or other characteristics) and more than a six-month period is required to make the required disposals.

While HMRC offers the option to pay IHT in instalments in some limited cases, this concession may not apply for estates with significant real estate assets or art collections.

Art finance – an alternative option

Obtaining a bridging loan secured against the real estate assets of the estate to settle IHT is not uncommon, however, due to the nature of bridging loans (particularly their relatively short loan term), interest rates and other fees can be unattractive as the finance costs can significantly deplete the residual value of the estate available to the beneficiaries.

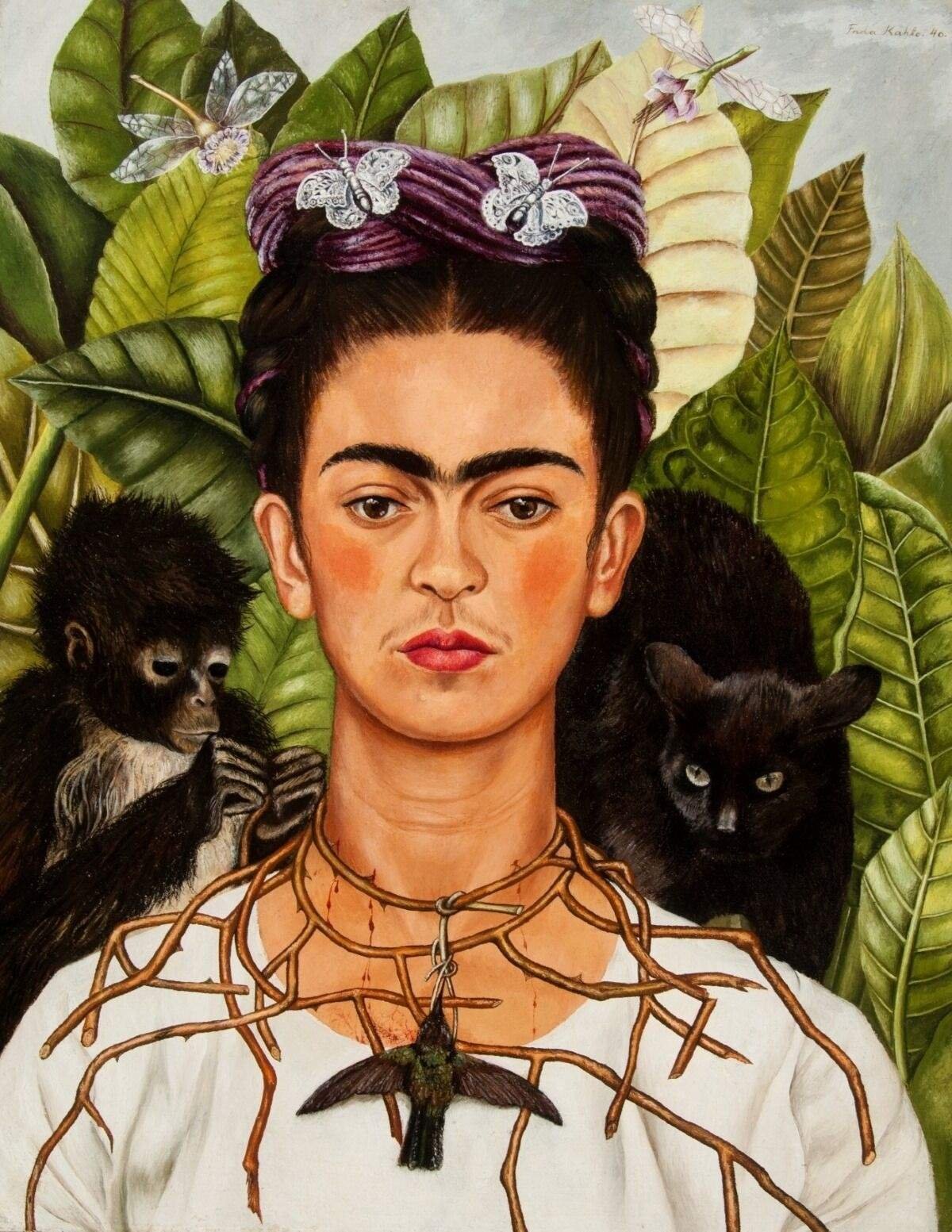

Where an estate includes valuable artworks (pieces or collections), art finance can be an attractive alternative method of raising the necessary liquidity to settle IHT payments given that it benefits from:

- quick execution and funding – similar to many bridging loans;

- a reduced scope of due diligence (often the artworks are the sole recourse and credit focus for lenders);

- flexible terms and structures; and

- depending on the artworks provided as collateral, comparatively attractive interest rates and finance costs.

While the terms and repayment structures will vary depending on the needs of the relevant borrower, the relevant lender’s credit criteria and the artwork(s) subject to security, loan terms are usually for periods of between six months and two years, although documentation can often provide for extension options.

In terms of repayment structure, this too is often bespoke but can include bullet repayments at the end of the loan term, interest-only payments (which can be ‘cash pay’ or capitalise) or amortisation payments (or a combination).

Crucially, the flexibility of art finance arrangements and the in-depth understanding that art lenders often have of the art market, means that trustees of estates are not required to sell artworks at inopportune times or at inappropriate venues in order to raise capital for the payment of IHT.

This benefit should not be underestimated as the optimal season and location of a sale will often depend on the nature of the relevant artwork itself (for example, in London, auctions of fine art – including contemporary paintings – tend to take place between September and December each year).

This is important for trustees contemplating the sale of artworks in the open market as any departure from these informal rules and customs may result in a material and adverse impact on the sales price of an artwork.

Trustees of estates intending to sell artwork in order to pay IHT (or other expenses) need to be attuned to this and art finance can provide them with the temporary liquidity required to pay IHT (or other expenses) and bridge the gap between when such payments are due and the most opportune time to list an artwork for sale.

Possession

One point that trustees need to have in mind when considering art finance is that given the movable nature of artworks and risks associated with unauthorised disposal or damage, lenders will require physical possession of the artworks being provided as security for their loan.

As a consequence, any artwork being provided as security will need to be transferred to a secure third-party fine art warehouse facility, which may be located in various jurisdictions throughout the world (including the United Kingdom, Switzerland, Hong Kong and the United States) in order to perfect the lenders’ security.

However, as artworks that form part of estates of high net worth individuals are often already located in third-party storage facilities (such as galleries, freeports and museums, as well as fine art warehouses), the transfer of the artwork from one third-party facility to another may be less problematic than is often envisaged.

Given the potential value stored in fine art, the speed at which funding can be provided, the flexibility of the loan terms available and the favourable finance costs involved, compared with traditional real estate bridging finance, trustees of the estates of high net worth individuals would be well advised to consider the art assets in an estate as an alternative source of liquidity and capital to settle estate costs such as IHT.

Tristan Dollie is counsel in the special situations and debt trading team at Brown Rudnick