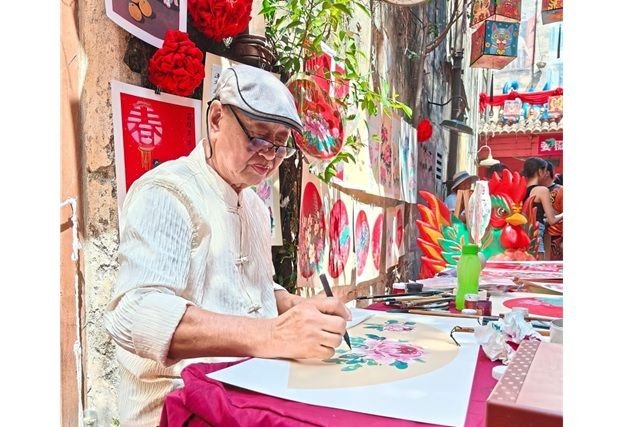

Lee Woo-hwan’s painting/ Courtesy of Yeolmae Company

By KTimes

Lee Yeon-hee, a 38-year-old office worker, has distinguished herself among her friends as an art investor.

Her foray into the art world started in 2019 with Damien Hirst’s “A Dream” and Lee has since expanded her portfolio to encompass works by acclaimed artists such as Lee Ufan, Park Seo-Bo, as well as David Hockney and Yayoi Kusama.

When asked how a salaried worker could afford to invest in artworks valued at billions to tens of billions of won, Lee cited something called fractional art investment as her secret weapon.

Fractional investment allows multiple people to pool their money to buy a single piece of artwork. For a small amount of money, ordinary investors can own a piece of a blue-chip artist’s work.

Lee invested about 1 million won ($750) per piece in 12 works, and sold stakes in four of them, earning an annual return of over 10 percent.

“My motto is ‘monetize my experience by investing in other people’s tastes,'” she said.

She also expresses interest in art investment securities and is eyeing an upcoming subscription for a work by American visual artist George Condo, indicating her proactive approach to expanding her investment portfolio.

Lee’s story not only highlights the accessibility of art investment through innovative means like fractional ownership, but also showcases the potential of art as a valuable addition to one’s investment portfolio.

After encountering a rocky start with underwhelming results in their inaugural subscription offering last year, companies specializing in fractional art investments are gearing up for a second round this month. The initial attempt faced challenges, including undersubscription and abandoned rights, sparking debates on the future viability of this innovative approach to art investment.

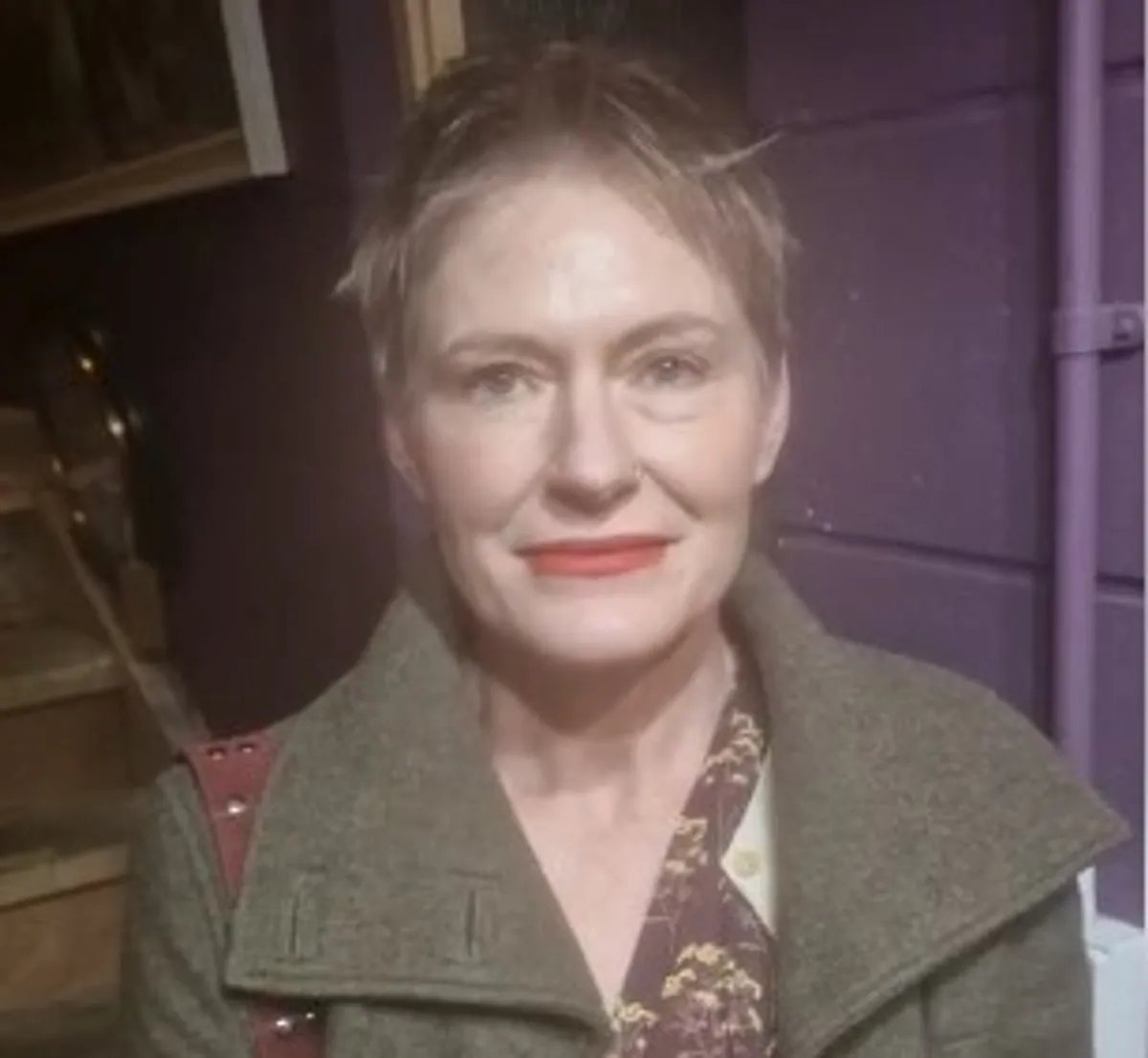

“The Horizon of Insanity,” a 2001 painting by American artist George Kondo/Courtesy of Art Together

The concept of fractional art investment gained traction among younger investors in the early 2020s, appealing to those without the means to make large upfront investments in the art market. The model, previously restricted to individual company platforms, marked a significant milestone in 2022 with the recognition of its legitimacy as an investment by the Financial Services Commission.

This led to the integration of fractional art investments into the formal securities market, highlighted by the issuance of South Korea’s first investment contract security at the end of last year with Japanese artist Yayoi Kusama’s “Pumpkin” as the underlying asset by Yeolmae Company.

Art Together, a subsidiary of art auction house K-Auction, has released the second security, “The Horizon of Insanity,” a 2001 painting by Condo. The artist, who has been called the “second Picasso,” uses distorted portraits and sculptures to bizarrely and wittily express the inner anxiety and transience of modern life.

The artwork will be on display to the public at K-Auction until Tuesday, and the subscription for 11,070 shares (100,000 won per share) will be held on March 26.

Lychee Company is presenting Lee Woo-hwan’s masterpiece “Dialogue,” consisting of 300 panels measuring 291×218 cm, as its second offering. Lee, a prominent figure in Korean contemporary art, holds the title of being the “highest-valued living artist in Korea.”

Starting on April 22, investors will be able to co-own a portion of the 1.15 billion won artwork for just 100,000 won. Seoul Auction Blue, a subsidiary of Seoul Auction, which offered Andy Warhol’s “Dollar Sign” in its first subscription, is also selecting artworks to be unveiled next month.

As the art sculpture investment market expands, the legal profession is also busy preparing art specialists. This is in anticipation of the growing demand for legal services due to the lack of a legal system.

Recently, Yulchon Law Firm hired foreign lawyer Lee Kyu-Young, an art investment specialist.

“Art sculpture investment securities do not allow you to dispose of the artwork before maturity, so you need to closely examine the price at which the artwork can be sold at the time of maturity,” said Lee. “Each sculpture investment company has a different maturity of three to five years, and it is possible to extend the maturity once, so it may be difficult to recover the investment for up to 10 years.”

Visitors watch a work by George Kondo at an exhibition hosted by Art Together at K-Auction./Courtesy of Art Together

Since investors only own a share of the artwork, rather than the artwork itself, they should also consider the possibility of losing their investment. A typical case is when a sculpture investment company goes bankrupt.

“The Financial Supervisory Service requires art investment companies to hold at least 5 percent of the value of the artwork in cash as an investor protection fund, but you should carefully read the securities to see what other investor protections are in place,” said Lee.

While it is feasible to invest in masterpieces of art with a modest amount of money, the key factor lies in the discernment of the investor.

“A famous artist’s work is by no means a guaranteed profit,” said Park Ki-tae, a lawyer at Hanzhong Law Firm. “Depending on the state of preservation, the art market conditions at the time of the sale, and market trends, it may become unpopular, so blindly investing in it may not pay off.”

This article from the Hankook Ilbo, a sister publication of The Korea Times, was translated by generative AI and edited by The Korea Times.