May 28, 2024 11:00 AM | 2 min read

27% profits every 20 days?

This is what Nic Chahine averages with his options buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

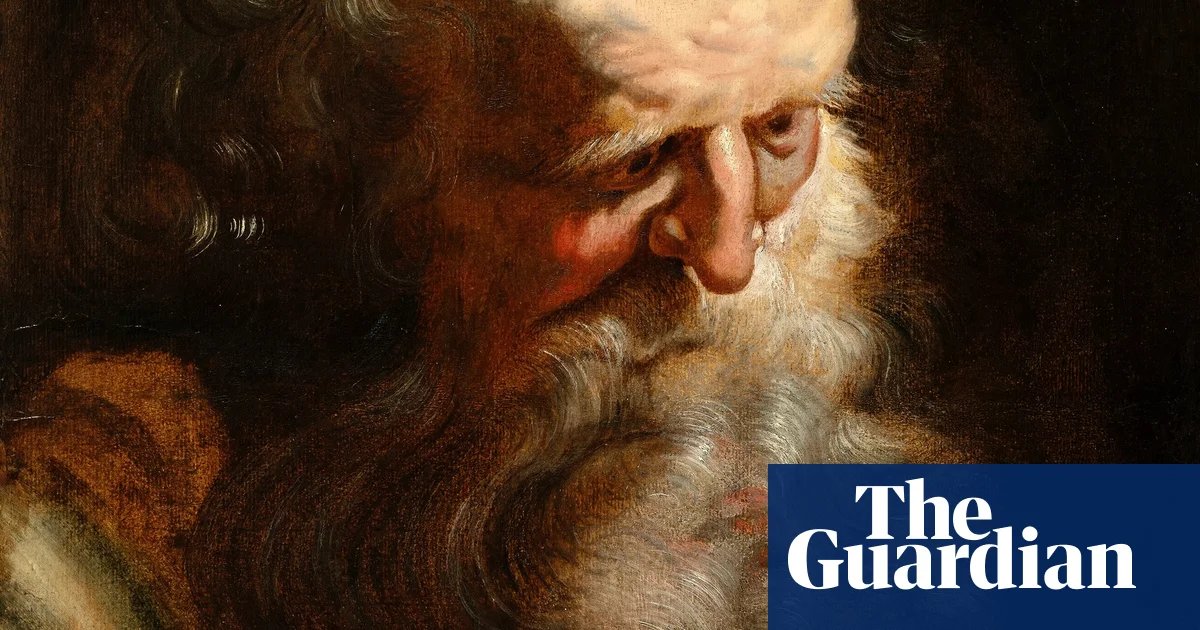

As the reigning titleholder of Forbes’ wealthiest individual for nearly two decades, Bill Gates has utilized his abundant resources to amass a renowned collection of esteemed art and artifacts valued at approximately $127 million. Winslow Homer’s masterpiece “Lost on the Grand Banks” is among its treasures, acquired for a staggering $36 million.

Not to be overshadowed is Gates’ possession of Leonardo DaVinci’s original journal, “The Leonardo Codex,” procured for roughly $30 million. Gates also boasts works by distinguished artists such as Childe Hassam, George Bellows, and William Merritt Chase.

Don’t Miss:

- Billionaires Jeff Bezos and Oprah Winfrey invest in this timeless and safe asset as a way to protect their money — Find out how you can too.

Why Investors Like Gates Are Willing to Drop $30 Million On Art and Artifacts

Art and artifacts investment are highly attractive to billionaires for several key reasons:

- Wealth Preservation: Art and artifacts by icons like Pablo Picasso and Leonardo DaVinci have long-lasting value, making them reliable for preservation across generations.

- Portfolio Diversification: Unlike traditional financial assets, art and artifacts often operate independently of stock markets. This characteristic provides stability during market fluctuations, making them valuable additions to diversified investment portfolios.

- Privacy: These markets allow for discreet transactions without the public disclosure requirements of securities trading. This confidentiality appeals to investors who prioritize privacy in their financial activities.

The Art Market Continues To Provide Impressive Returns To Investors

The UBS Billionaires Report of 2023 revealed that in the latter half of 2023 and 2024, over half of the ultrawealthy collectors surveyed plan to purchase art, maintaining last year’s levels. Additionally, 77% of these collectors remain confident in the art market’s performance over the next six months, indicating a strong baseline of resilience within the sector. Citi also reports that diversifying with as little as 5% in contemporary art can enhance long-term performance 98% of the time. Despite these eye-opening numbers, most portfolios remain limited to stocks and bonds due to lack of accessibility.

For most, investing in art on such a grand scale is simply out of reach financially. However, art investing platforms like Masterworks are transforming the landscape. Masterworks streamlines the process of investing in multimillion-dollar paintings by celebrated artists such as Banksy and Picasso. They’ve achieved 21 successful exits, boasting annualized net returns of 14.6%, 17.8%, and 36.2%. For those aspiring to tread the path of billionaire art investors, Masterworks may stand as a gateway to the art market.

Read Next:

27% profits every 20 days?

This is what Nic Chahine averages with his options buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

ENTER TO WIN $500 IN STOCK OR CRYPTO

Enter your email and you’ll also get Benzinga’s ultimate morning update AND a free $30 gift card and more!

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.