WHY should investors trade or invest in a yellow mineral called gold? The answer lies in the characteristics of gold itself such as: It does not rust or corrode; it can be divided into measurable quantities that can be stored; and it is acceptable as a medium of exchange everywhere and by everyone.

As the saying goes: “It is just as good as gold”. The yellow mineral is regularly referred to as a so-called safe-haven asset, a place for investors to shelter with their wealth during uncertain times.

It historically benefits from flight-to-quality inflows during periods of heightened risk and, by providing positive returns and reducing portfolio losses.

The norm amongst most investors all over the world is that they tend to buy and hold gold during periods of uncertainty. For example, the effect of General Qasem Suleimani’s death was an additional upward tick for gold prices. He was an Iranian major-general killed by an American drone strike in Baghdad.

There are several other factors that are supportive for gold prices, such as a weaker dollar, central bank policies and uncertainty over global trade issues.

Gold is one of the world’s oldest traded commodities. Unlike other assets, it does not produce a dividend. It is not an asset class for everyone. Warren Buffett, America’s most celebrated investor dislikes it. Gold, he once said, “gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility.”

Keep Reading

One of Warren Buffet’s principles is to invest in what you understand. It is also worth noting that in some cases, gold has failed to protect against a loss in the purchasing power of the dollar. This has also cast some doubt on the ability of the ordinary investor to protect himself against inflation by putting money in gold. As a result, investors are looking at new categories of “things” or “valuable objects” that have had striking advances in market value over the years, such as art, first editions of books, rare stamps, and coins.

More and more investors are looking at the art market (and other collectables) as an alternative to traditional investment assets. Wealth managers globally have reported that clients are asking for help with investments in art and collectibles.

Unlike shares, bonds, and commodities, for instance, each work of art is a unique entity that cannot be replaced by another. The rarity of a work of art is what gives it value.

Art can be defined as a diverse range of human activities in creating visual, auditory, or performing artworks, expressing the author’s imaginative, conceptual ideas, or technical skill, intended to be appreciated for their beauty or emotional power.

The three classical branches of art are painting, sculpture and architecture. Most definitions of art mention an idea of imaginative or technical skill stemming from human agency and creation. On the other hand, the word art may refer to several things: A study of a creative skill, a process of using the creative skill, a product of the creative skill, or the audience’s experience with the creative skill.

Art is viewed as an alternative investment given that it has no correlation to the stock market. The price of paintings can go up in value even when the market crashes, making it a good diversification for an investment portfolio.

Since it is impossible to determine an artwork’s true value — a lot depends on the artist’s reputation. Every artwork is unique, and the art market has ups and downs just like any other market. Investors should be comfortable assuming some risk.

So, is investing in paintings a good way to get rich fast? An event that attracted a lot of attention was in 2017 when a record price was fetched for Leonardo da Vinci’s “Salvator Mundi” (saviour of the world) for US$450 million in November, sold by Christie’s in New York.

Stories like the Leonardo painting make it seem attractive, but such cases are relatively rare. Most art industry experts suggest that you buy a piece of art because you like it, not because you want to get rich.

That said, most high net worth individuals are spending an increasing part of their wealth on art and collectibles.

Then there are the collectors — people who buy and sell items whose value are far more than their original worth. It is possible to make money by buying and selling collectibles.

Collectibles are items that can be purchased or sold for much more than their original value. If they are rare, they can be worth even more. The collectible market is enormous and there is need to develop a robust art and collectibles market in Zimbabwe.

An increased focus on alternative investments amongst institutional investors could transform the art and collectibles space in Zimbabwe.

Overall, one may consider collecting “things” in anticipation of a shift in the universe of assets considered as alternative investments. This may even entail collecting paintings, old records, cigar rings, marbles, and coat hangers.

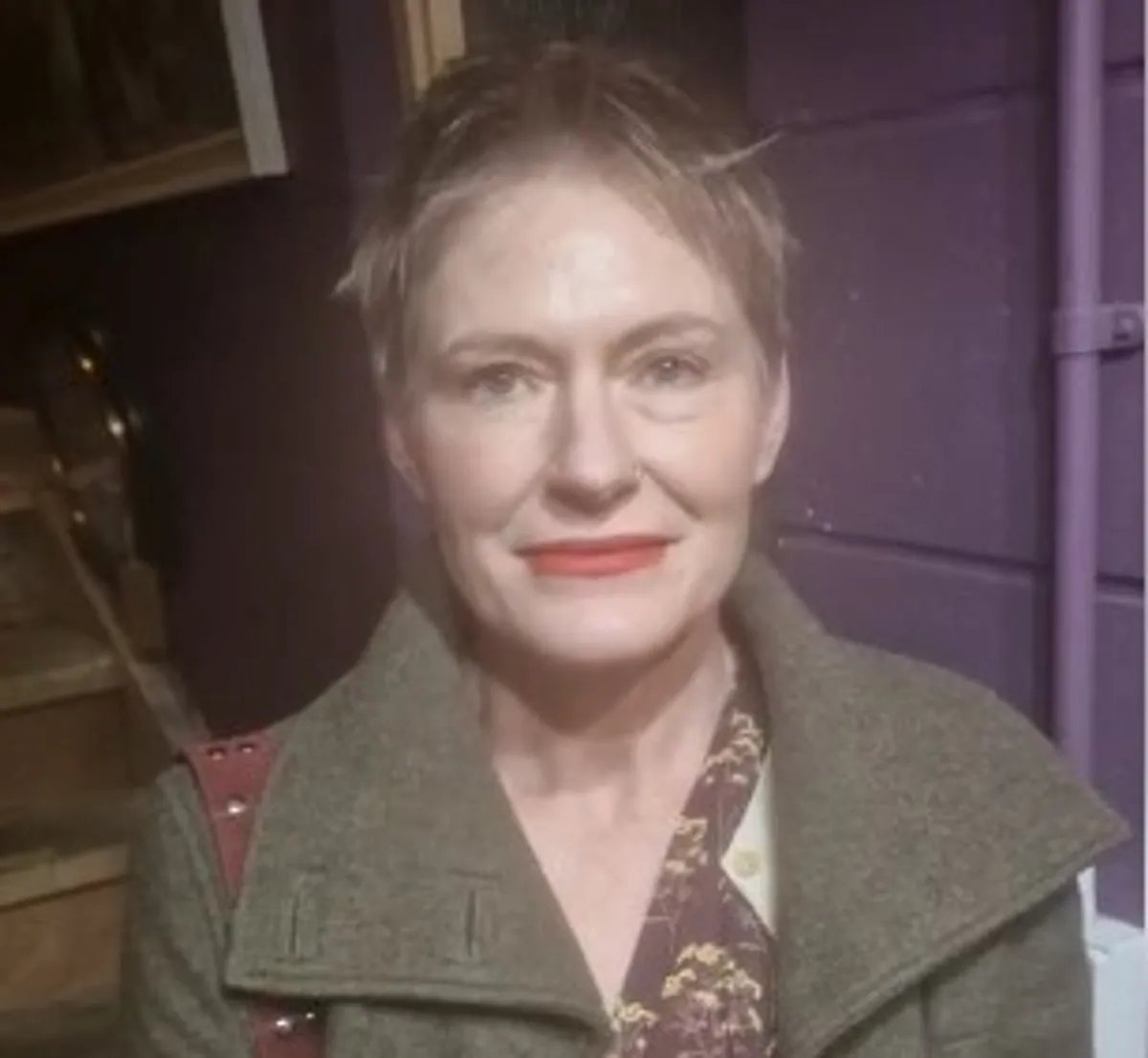

- Matsika is a corporate finance specialist with Switz View Wealth Management. — +263 78 358 4745/ batanaim@switzview.com

Share this article on social